As filed with the Securities and Exchange Commission on August 18, 201110, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

GLOBAL PAYMENTS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

GLOBAL PAYMENTS INC.

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

NOTICE OF 20112012 ANNUAL MEETING OF SHAREHOLDERS

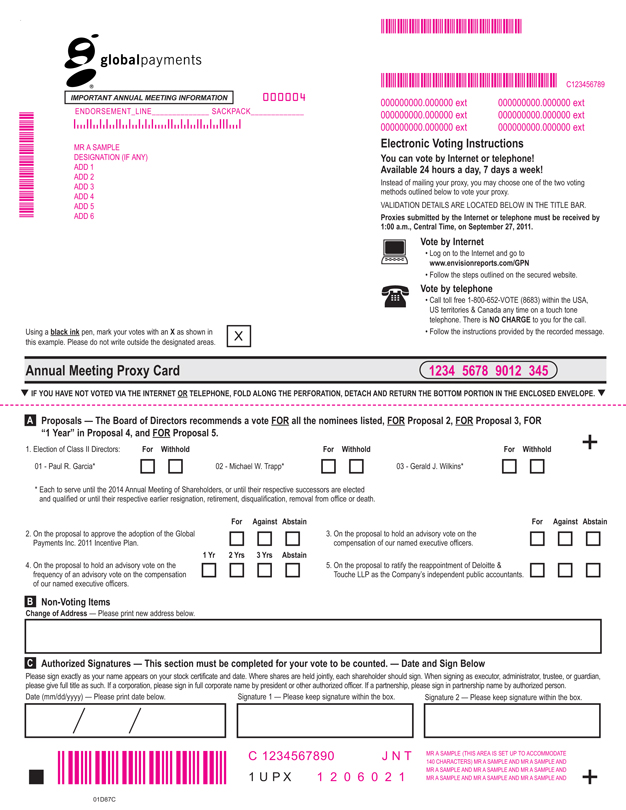

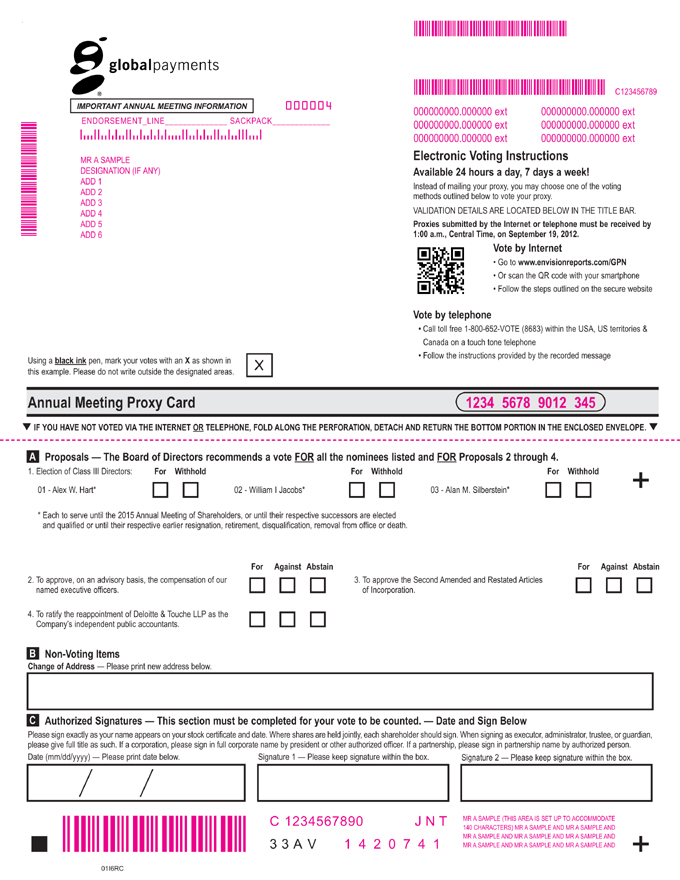

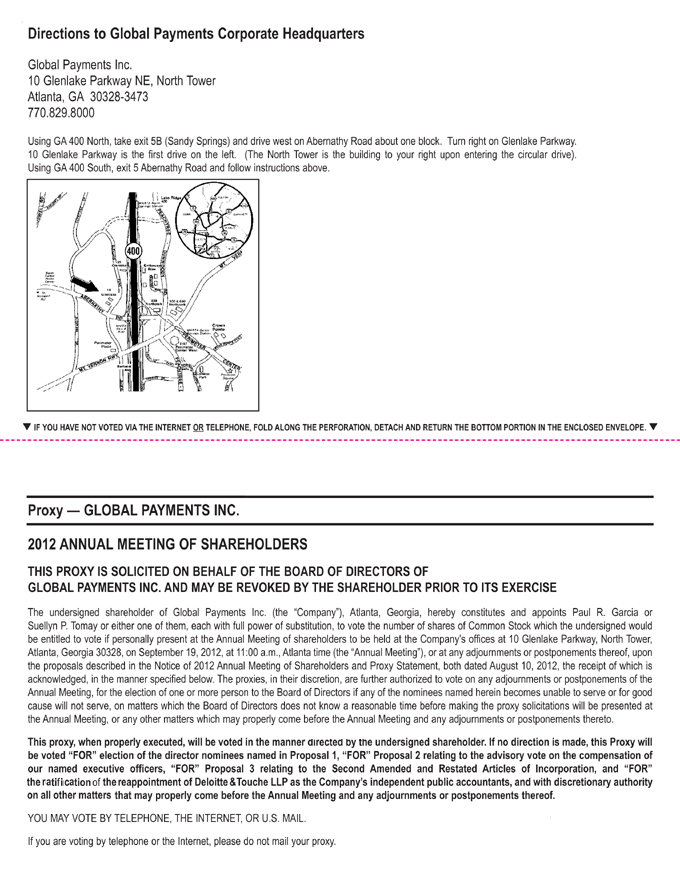

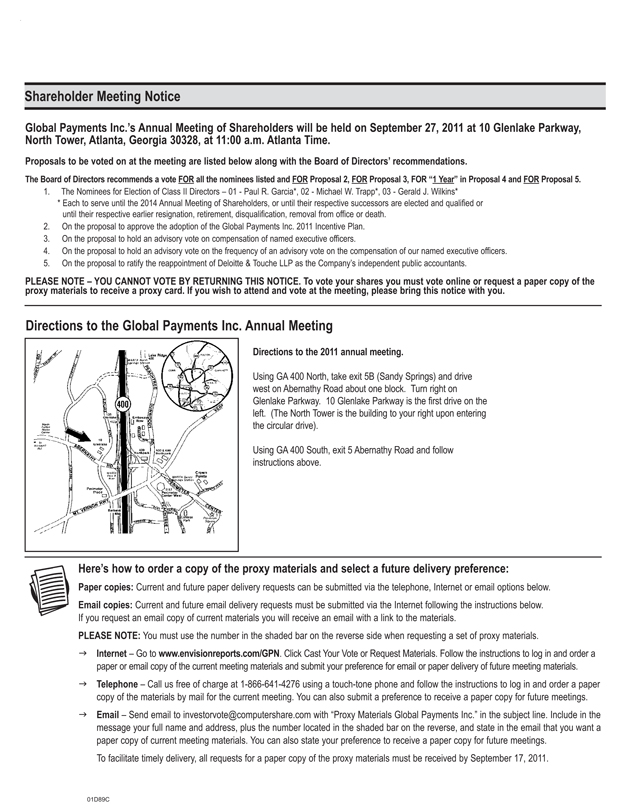

The 20112012 annual meeting of shareholders (the “Annual Meeting”) of Global Payments Inc., or the Company, will be held at our offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 27, 2011,19, 2012, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class |

| 2. | To approve, |

| To |

| To ratify the reappointment of Deloitte & Touche LLP as the Company’s independent public |

The shareholders may also transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only shareholders of record at the close of business on August 8, 20111, 2012 are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. You may vote your shares via the Internet or by telephone, as instructed in the Notice of Electronic Availability of Proxy Materials, or if you received your proxy materials by mail, you may also vote by mail.

YOUR VOTE IS IMPORTANT

Submitting your proxy does not affect your right to vote in person if you attend the Annual Meeting. Instead, it benefits us by reducing the expenses of additional proxy solicitation. Therefore, you are urged to submit your proxy as soon as possible, regardless of whether or not you expect to attend the Annual Meeting. You may revoke your proxy at any time before its exercise by (i) delivering written notice of revocation to our Corporate Secretary, Suellyn P. Tornay, at the above address, (ii) submitting to us a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 1:00 a.m., Central Time, on September 27, 2011.19, 2012.

When you submit your proxy, you authorize Paul R. Garcia or Suellyn P. Tornay or either one of them, each with full power of substitution, to vote your shares at the Annual Meeting in accordance with your instructions or, if no instructions are given, for the election of the Class IIIII nominees, for the approval of the adoption of the Global Payments Inc. 2011 Incentive Plan, for the approval, on an advisory basis, of the compensation of our named executive officers, for a frequencythe approval of every year (1 year) for future advisory votes on the compensationSecond Amended and Restated Articles of our named executive officers,Incorporation, and for the ratification of the reappointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent public accountants. The proxies, in their discretion, are further authorized to vote on any adjournments or postponements of the Annual Meeting, for the election of one or more persons to the Board of Directors if any of the nominees becomes unable to serve or for good cause will not serve, on matters which the Board does not know a reasonable time before making the proxy solicitations will be presented at the Annual Meeting, or any other matters which may properly come before the Annual Meeting and any postponements or adjournments thereto.

By Order of the Board of Directors,

SUELLYN P. TORNAY,

Executive Vice President,

General Counsel and Corporate Secretary

Dated: August 18, 201110, 2012

August 18, 201110, 2012

GLOBAL PAYMENTS INC.

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

PROXY STATEMENT

| A. | Introduction |

This Proxy Statement is being furnished to solicit proxies on behalf of the Board of Directors of Global Payments Inc. (the “Company” or “we”) for use at the 20112012 annual meeting of shareholders (the “Annual Meeting”), and at any adjournments or postponements thereof. The Annual Meeting will be held at our offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 27, 2011,19, 2012, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class |

| 2. | To approve, |

| To |

| To ratify the reappointment of Deloitte & Touche LLP as the Company’s independent public |

The shareholders may also transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Notice of Electronic Availability of Proxy Statement and Annual Report.As permitted by the Securities and Exchange Commission (“SEC”) rules, we are making this proxy statement and our annual report available to our shareholders electronically via the Internet. The notice of electronic availability contains instructions on how to access this proxy statement and our annual report and vote online. You will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your proxy over the Internet or by telephone. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the notice.

The Notice of Electronic Availability of Proxy Materials and this Proxy Statement are first being mailedmade available to shareholders on or about August 18, 2011.10, 2012.

| B. | Quorum and Voting |

(1) Voting Shares.Pursuant to our Amended and Restated Articles of Incorporation, only the Company’s common shares, no par value (the “Common Stock”), may be voted at the Annual Meeting.

(2) Record Date.Only those holders of Common Stock of record at the close of business on August 8, 2011,1, 2012, are entitled to receive notice and to vote at the Annual Meeting or any adjournment or postponement thereof. On that date, there were 80,602,143approximately 78,900,000 shares of Common Stock issued and outstanding, held by approximately 2,3052300 shareholders of record. These holders are entitled to one vote per share.

(3) Quorum.In order for any business to be conducted, the holders of a majority of the shares entitled to vote at the Annual Meeting must be present (a “Quorum”), either in person or represented by proxy. Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for

3

purposes of determining the existence of a Quorum at the Annual Meeting. They will not be considered as votes “for” or “against” any matter for which the respective shareholders have indicated their intention to abstain or withhold their votes, but in some instances may be considered votes “cast.” Broker or nominee non-votes, which occur when shares held in “street name” by brokers or nominees who indicate that they do not have discretionary authority to vote on a particular matter, will not be considered as votes “for” or “against” that particular matter. Broker and nominee non-votes will be treated as present for purposes of determining the existence of a Quorum and may be entitled to vote on other matters at the Annual Meeting.

3

(4) Voting Options. The first proposal, which is the election of three directors in Class II,III, will require the vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a Quorum is present. Shareholders may (i) vote “for” each nominee, or (ii) “withhold” authority to vote for any nominee. If a Quorum is present, a vote to “withhold” and a broker non-vote will have no effect on the outcome of the election of directors. The three nominees receiving the most votes will be elected to serve as the Class IIIII Directors for a three-year term.

With respect to the second proposal, the approval of the Global Payments Inc. 2011 Incentive Plan requires the affirmative vote of a majority of the votes cast; provided that the total votes cast on the proposal must represent over 50% of the total outstanding shares of our Common Stock. Abstentions are counted as votes “cast” for purposes of this proposal, and therefore will result in the proposal receiving fewer votes and thus have the same effect as a vote against the proposal. Broker non-votes will be treated as not entitled to vote on this proposal, and therefore will affect the outcome of a vote only to the extent that broker non-votes could impair our ability to satisfy the NYSE requirement that the total votes cast on this proposal represent over 50% of the total outstanding shares of our Common Stock.

With respect to the third proposal, the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers as described in this Proxy Statement requires that the votes cast in favor of the proposal exceed the votes cast against the proposal. Shareholders may (i) vote “for,” (ii) vote “against,” or (iii) “abstain” from voting on the proposal. Abstentions and broker non-votes will not affect the outcome of this proposal.

With respect to the fourththird proposal, to approve the advisory (non-binding)Second Amended and Restated Articles of Incorporation requires the affirmative vote on the frequency of the advisoryholders of at least two-thirds (2/3) of all classes of stock entitled to vote. Shareholders may (i) vote on the compensation of our named executive officers, shareholders have three options of frequency, and they may“for,” (ii) vote for every (i) 1 year, (ii) 2 years,“against,” or (iii) 3 years, or (iv) “abstain” from voting on the proposal. The frequency option that receives the most affirmative votes of all the votes cast on proposal four is the frequency that will be deemed recommended by the Company’s shareholders. Abstentions and broker non-votes will have no effect in determining the frequency option that is recommended by shareholders.be treated as a vote against this proposal.

With respect to the fifthfourth proposal, the ratification of Deloitte as the Company’s independent public accountants for the fiscal year ending May 31, 2012,2013, requires that the votes cast in favor of the proposal exceed the votes cast against the proposal. Shareholders may (i) vote “for,” (ii) vote “against,” or (iii) “abstain” from voting on the proposal. Abstentions will have no effect on the outcome of the reappointment of Deloitte as the Company’s independent public accountants.

(5) How to Vote.If you received a notice of electronic availability, you cannot vote your shares by filling out and returning the notice. The notice, however, provides instructions on how to vote by Internet, by telephone, or by requesting and returning a paper proxy card.

(6) Internet and Telephone Voting. Shareholders of record can simplify their voting and reduce our costs by voting their shares via the Internet or by telephone. Shareholders may submit their proxy voting instructions via the Internet or telephone by following the instructions provided in the notice of electronic availability. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. If your shares are held in the name of a bank or a broker, the availability of Internet and telephone voting will depend on the voting processes of the applicable bank or broker; therefore, it is recommended that you follow the voting instructions on the form you receive. If you received a printed version of the proxy materials by mail, you may vote by following the instructions provided with your proxy materials and on your proxy card.

(7) Default Voting.When a proxy is timely executed and not revoked, the shares represented by the proxy will be voted in accordance with the instructions indicated in the proxy. IF NO INSTRUCTIONS ARE INDICATED, HOWEVER, PROXIES WILL BE VOTED “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES

4

NAMED IN PROPOSAL 1, “FOR” THE APPROVAL OF THE ADOPTION OF THE GLOBAL PAYMENTS INC. 2011 INCENTIVE PLAN IN PROPOSAL 2, “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS IN PROPOSAL 3,2, “FOR” A FREQUENCYTHE APPROVAL OF EVERY YEAR (1 YEAR) FOR FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATIONTHE SECOND AMENDED AND RESTATED ARTICLES OF INCORPORATION IN PROPOSAL 4,3, AND “FOR” PROPOSAL 54 RELATING TO THE RATIFICATION OF THE REAPPOINTMENT OF DELOITTE AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS.

The Board of Directors is not presently aware of any business to be presented for a vote at the Annual Meeting other than the proposals noted above. If any other matter properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is made, in their own discretion.

(8) Revocation of a Proxy.A shareholder’s submission of a proxy via the Internet, by telephone, or by mail does not affect the shareholder’s right to attend in person. A shareholder who has given a proxy may revoke it at any time prior to its being voted at the Annual Meeting by (i) delivering written notice of revocation to our Corporate Secretary, Suellyn P. Tornay, at our address listed on the first page of this proxy statement, (ii) properly submitting to us a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 1:00 a.m. Central Time on September 27, 2011.19, 2012.

4

(9) Adjourned Meeting.If a Quorum is not present, the Annual Meeting may be adjourned by the holders of a majority of the shares of Common Stock represented at the Annual Meeting. The Annual Meeting may be rescheduled at the time of the adjournment with no further notice of the reconvened meeting if the date, time and place of the reconvened meeting are announced at the adjourned meeting before its adjournment; provided, however, that if a new record date is or must be fixed, notice of the reconvened meeting must be given to the shareholders of record as of the new record date. An adjournment will have no effect on the business to be conducted at the meeting.

PROPOSAL ONE:

ELECTION OF DIRECTORS; NOMINEES

Our Bylaws provide that the number of directors constituting the Board of Directors shall be not less than two or more than twelve, as determined from time to time by resolution of the shareholders or of the Board of Directors. Our Board of Directors has adopted a resolution that the Board should have nine members. The Board of Directors currently consists of nine members, who are divided into three classes, with the term of office of each class ending in successive years. Each class of directors serves staggered three-year terms.

The three directors in Class II, Paul R. Garcia, Gerald J. Wilkins,III, Alex W. Hart, William I Jacobs, and Michael W. TrappAlan M. Silberstein have been nominated for election at the Annual Meeting. The Class IIIII Directors will be elected to hold office until the 20142015 annual meeting of shareholders, or until their respective successors have been duly elected and qualified, or until their respective earlier resignation, retirement, disqualification, removal from office or death. In the event that any of the nominees is unable to serve (which is not anticipated), the persons designated as proxies will cast votes for such other person(s) as they may select.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR.

The affirmative vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a Quorum is present is required for the election of each of the nominees. If a choice is specified on the proxy card by a shareholder, the shares will be voted as specified. If no specification is made, the shares will be voted “FOR” each of the three nominees.

| A. | Certain Information Concerning the Nominees and Directors |

The following table setspages set forth the names of the nominees and the directors continuing in office, their ages, the month and year in which they first became directors of the Company, their positions with the Company, their principal occupations and employers for at least the past five years, any other directorships held by them in the last five years in

5

companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 (the “ExchangeExchange Act”) or any company registered as an investment company under the Investment Company Act of 1940, as well as additional informationinformation. The following table includespages include the experience that led the Board of Directors to conclude that the individual should continue to serve as a director of the Company. There is no family relationship between any of our executive officers or directors. There are no arrangements or understandings between any of our directors and any other person pursuant to which any of them was elected as a director, other than arrangements or understandings with the directors solely in their capacities as such. For information concerning membership on committees of the Board of Directors, see “Other“Other Information about the Board and its Committees”Committees” below.

5

NOMINEES FOR DIRECTOR

Class II

Term Expiring Annual Meeting 2011

|

| |

| ||

|

| |

|

| |

6

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class III

Term Expiring Annual Meeting 2012

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

Alex W. Hart

| Director of the Company (since February 2001) Business Consultant (since October 1997); Chief Executive Officer of Advanta Corporation (1995-1997); Executive Vice Chairman of Advanta Corporation (1994); President and Chief Executive Officer of MasterCard International (1988-1994); Director, Fair Isaac Corporation, Miter Systems, Inc., and VeriFone, Inc.; Chairman of the Board and Director, SVB Financial Group. | |

| Mr. Hart brings to our Board substantial experience in our industry, having served as the President and Chief Executive Officer of MasterCard and has served as a director of several companies. Because of such experience, we believe Mr. Hart has a deep understanding of the strategic and operational issues we face and provides useful insight to our Board as we review our strategic initiatives. Mr. Hart serves as the Chairman of our Governance, Nominating, and Risk Oversight Committee. | ||

William I Jacobs

| Director of the Company (since February 2001) Business Advisor (since August 2002); Managing Director and Chief Financial Officer of The New Power Company (2000-2002) | |

| Mr. Jacobs’ executive management experience, leadership skills, board expertise, and legal training provide our Board with leadership and consensus building skills on matters of strategic importance. Mr. Jacobs serves a vital role as our lead director. | ||

Alan M. Silberstein

| Director of the Company (since September 2003) President, Allston Associates LLP (previously Silco Associates Inc.) (since October 2004) | |

| Mr. Silberstein’s experience in the financial services industry and his experience managing several diverse companies provide an important point-of-view to our Board. | ||

| Provider of online collections |

76

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class I

Term Expiring Annual Meeting 2013

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

Edwin H. Burba, Jr.

| Director of the Company (since February 2001) National Security Leadership and Business Consultant (since 1993); Commander in Chief, Forces Command, United States Army (1989-1993); Commanding General, Combined Field Army of the Republic of Korea and United States (1988-1989). | |

| General Burba had an extensive career in the military and retired from the army in 1993 as the Commander-in-Chief, Forces Command, Fort McPherson, Georgia. His leadership skills and experience managing people | ||

Raymond L. Killian

| Director of the Company (since September 2003) Chairman Emeritus, Investment Technology Group, Inc. (since March 2007) (1); Chairman, Investment Technology Group, Inc. (1997-2007); President and Chief Executive Officer, Investment Technology Group, Inc. (1995-2002 and 2004-2007); Executive Vice President, Jefferies Group, Inc. (1985-1995); Vice President, Institutional Sales, Goldman Sachs & Co. (1982-1985). | |

| In addition to the specific experience described above, Mr. Killian brings to our Board his experience managing a complex, publicly traded company. With his skills and expertise obtained in | ||

Ruth Ann Marshall

| Director of the Company (since September 2006) President, Americas for MasterCard International (2000-2006) | |

| Because of Ms. Marshall’s deep knowledge of our business and industry as well as her detailed and in-depth knowledge of the issues, opportunities and challenges facing us, we believe that she is an invaluable member of our Board of Directors. | ||

| Specialized agency brokerage and technology |

7

Class II

Term Expiring Annual Meeting 2014

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

Paul R. Garcia (60) | Chairman of the Board of the Company (since October 2002); Director and Chief Executive Officer of the Company (since February 2001); Chief Executive Officer of NDC eCommerce, a division of National Data Corporation (July 1999 - January 2001); President and Chief Executive Officer of Productivity Point International (March 1997 – September 1998); Group President of First Data Card Services (1995 – 1997); Chief Executive Officer of National Bancard Corporation (NaBANCO) (1989 – 1995). Director, Dun & Bradstreet Corp. (since May 2012). | |

| Mr. Garcia’s leadership skills, extensive knowledge of and experience in the payment services and financial services industries, and his understanding of our business and historical development give him unique insight into our challenges, opportunities, and business. | ||

Gerald J. Wilkins (54) | Director of the Company (since November 2002) President, WJG Consulting, Inc. (2003-2007 and 2008 to present) (1); Chief Financial Officer, Habitat for Humanity International (2007-2008) (2); Executive Vice President and Chief Financial Officer of AFC Enterprises, Inc. (2000-2003); Chief Financial Officer of AFC Enterprises, Inc. (1995-2000); Vice President, International Business Planning, KFC International (1993-1995). | |

| Mr. Wilkins’ experience as a principal financial officer of several organizations provides an important perspective to our Board regarding finance and accounting matters. | ||

Michael W. Trapp (72) | Director of the Company (since July 2003) President, Sands Partners, Inc. (since 2000) (3); Managing Partner, Southeast area, Ernst & Young LLP (1993-2000); Director, Ann Inc. | |

| Mr. Trapp brings to the Board expertise and knowledge regarding finance and accounting matters, enabling him to provide valuable leadership to the Board’s oversight of financial reporting. He serves as the Chairman of our Audit Committee and qualifies as an “audit committee financial expert” under the applicable SEC rules. | ||

| Note 2: | Nonprofit housing ministry |

| Note 3: | Investment business |

8

| B. | Other Information about the Board and its Committees |

(1) Meetings.During the fiscal year ended May 31, 20112012 (the 20112012 fiscal year), our Board of Directors held seveneight meetings. All directors attended 100% of the combined total of the Board of Directors meetings and meetings of the committees on which they served during the period for which the respective director served on the Board of Directors or the applicable committee.committee, except for Mr. Hart who attended 92% of all such meetings and Mr. Killian who attended 90% of all such meetings.

(2) Fiscal Year 20112012 Director Compensation. The following table reflects the compensation payable to the outside directors of the Company. Since we do not offer any non-equity incentive plan compensation or any pension benefits to our directors, and there was no other compensation required to be disclosed, columns (e) and (g) have been eliminated.

8

20112012 DIRECTOR COMPENSATION

Name | Fees Earned or Paid in Cash ($) | Stock Awards (1) ($) | Option Awards (2) ($) | Change in Nonqualified Deferred Compensation Earnings (4) ($) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards (1) ($) | Nonqualified Deferred Compensation Earnings (2)($) | Total ($) | |||||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (f) | (h) | (b) | (c) | (f) | (h) | |||||||||||||||||||||||||||

Edwin H. Burba, Jr. | $ | 81,500 | $ | 80,017 | $ | 44,996 | — | $ | 206,513 | $ | 81,000 | $ | 125,000 | — | $ | 206,000 | ||||||||||||||||||||

Paul R. Garcia (3) | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Alex W. Hart | $ | 84,000 | $ | 80,017 | $ | 44,996 | — | $ | 209,013 | $ | 79,000 | $ | 125,000 | — | $ | 204,000 | ||||||||||||||||||||

William I Jacobs | $ | 130,500 | $ | 105,007 | $ | 44,996 | — | $ | 280,503 | $ | 121,500 | $ | 150,000 | — | $ | 271,500 | ||||||||||||||||||||

Raymond L. Killian | $ | 83,500 | $ | 80,017 | $ | 44,996 | — | $ | 208,513 | $ | 74,000 | $ | 125,000 | — | $ | 199,000 | ||||||||||||||||||||

Ruth Ann Marshall | $ | 69,000 | $ | 80,017 | $ | 44,996 | $ | 0 | $ | 194,013 | $ | 68,500 | $ | 125,000 | — | $ | 193,500 | |||||||||||||||||||

Alan M. Silberstein | $ | 74,000 | $ | 80,017 | $ | 44,996 | $ | 0 | $ | 199,013 | $ | 71,000 | $ | 125,000 | — | $ | 196,000 | |||||||||||||||||||

Michael W. Trapp | $ | 92,500 | $ | 80,017 | $ | 44,996 | — | $ | 217,513 | $ | 88,500 | $ | 125,000 | — | $ | 213,500 | ||||||||||||||||||||

Gerald J. Wilkins | $ | 69,500 | $ | 80,017 | $ | 44,996 | — | $ | 194,513 | $ | 68,000 | $ | 125,000 | — | $ | 193,000 | ||||||||||||||||||||

| The amounts shown in the Stock Awards column reflect aggregate grant date fair value of such awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“FASB ASC Topic 718”). The amount shown in this column was determined by multiplying the number of shares received by the value of the Common Stock on the date of the grant. Additional details regarding the stock awards are set forth in the section entitled “Compensation Policy” below. Such shares are entitled to receive dividends once issued but at the same rate as all of the Company’s shareholders. As of May 31, |

| All of the non-employee |

| Note 3: | Mr. Garcia is a member of the Board of Directors and is also the Chief Executive Officer of the Company and does not receive any additional compensation for his role as a director. |

9

(3) Compensation Policy.During fiscal year 2011,2012, our policy regarding the compensation of our non-employee directors provided that a non-employee director who servedis summarized as the lead director was compensated at a rate of $105,000 per year in cash and received fully-vested shares of Common Stock worth approximately $105,000. A non-employee director who served as the chairperson of the audit committee received $75,000 in cash and fully-vested shares of Common Stock worth approximately $80,000. A non-employee director who served as the chairperson of the compensation committee received $65,000 in cash and fully-vested shares of Common Stock worth approximately $80,000. A non-employee director who served as a chairperson of any other committee received $60,000 in cash and fully-vested shares of Common Stock worth approximately $80,000. Each other non-employee director received an annual retainer of $55,000 in cash and fully vested shares of Common Stock worth approximately $80,000. follows:

Director | Basic Cash Retainer | Supplemental Cash Retainer | Annual Stock Retainer | |||||||||

Lead Director | $ | 55,000 | $ | 50,000 | $ | 150,000 | ||||||

Chairman of Audit Committee | $ | 55,000 | $ | 20,000 | $ | 125,000 | ||||||

Chairman of Compensation Committee | $ | 55,000 | $ | 10,000 | $ | 125,000 | ||||||

Chairman of Other Committees | $ | 55,000 | $ | 5,000 | $ | 125,000 | ||||||

All other non-employee directors | $ | 55,000 | N/A | $ | 125,000 | |||||||

All Common Stock granted pursuant to the director compensation policyannual stock retainer described immediatelyin the table above is valued at the market price as of the date of grant and is issued under our Amended and Restated 20052011 Incentive Plan. Pursuant to the foregoing policy, Mr. Jacobs received 2,4963,736 shares of Common Stock, and each of the other non-employee directors received 1,9023,113 shares of Common Stock. Such Common Stock was issued and cash was paid on September 28, 2011, the business day following the annual meeting of shareholders in

9

2010. 2011. We believe that paying part of the annual consideration in Common Stock encourages ownership of our Common Stock by our directors.

In addition, all non-employee directors received $1,500 per Board meeting attended, except for the lead director who received $2,500 per Board meeting. Non-employee directors who served on a committee received $1,500 per committee meeting, while the chairperson of such committee received $2,500 per committee meeting. Telephonic meetings and telephonic participation for both Board meetings and committee meetings are compensated at $1000$1,000 per meeting. We do not compensate a director who is also an employee of the Company for his or her services as a director. Directors were also compensated for their out-of-pocket expenses incurred in connection with attendance at Board and committee meetings.

Also, in fiscal year 2011, each of our non-employee directors received an option to purchase shares of Common Stock having a valuation according to the Black-Scholes option pricing model of $45,000. These options were issued on the day following the annual meeting of shareholders in 2010 pursuant to the Amended and Restated 2000 Non-Employee Director Stock Option Plan, as amended (the “2000 Director Plan”). We believe that the option grants advance the interests of the Company by encouraging ownership of our Common Stock by non-employee directors, thereby giving such directors an increased incentive to devote their efforts to our success. The options are granted to non-employee directors upon election or appointment to the Board and on the business day following each annual meeting of shareholders. Option grants under the 2000 Director Plan are pro-rated for partial years of service. All options granted in fiscal year 2011 under the 2000 Director Plan will become exercisable as to 25% of the shares after the first year, 25% after the second year, 25% after the third year, and 25% after the fourth year of service from the grant date, except that such options will become fully exercisable upon the death, disability or retirement of the grantee, or upon the grantee’s failure to be re-nominated or re-elected as a director. Upon a grantee’s termination as a director for any reason, the options held by such person under the 2000 Director Plan will remain exercisable for five years or until the earlier expiration of the option. The exercise price for each option granted under the 2000 Director Plan will be the fair market value of the shares of Common Stock subject to the option on the date of the grant. Each option granted under the 2000 Director Plan will, to the extent not previously exercised, terminate and expire on the date which is 10 years after the grant date of the option unless the 2000 Director Plan provides for earlier termination. During fiscal year 2011, the eight non-employee directors received a stock option grant for the purchase of 3,612 shares of Common Stock at an exercise price of $42.07 per share. The grant made to the directors on October 1, 2010 will be the last grant awarded from the 2000 Director Plan because it terminated on October 2, 2010 according to its terms.

(4) Outstanding Options for Directors.The following table reflects the outstanding options (vested and unvested) for each non-employee director as of May 31, 2011.2012. The “spread” value contained in the third column is calculated by multiplying the number of options outstanding by the difference between the value of the Common Stock at the closing price on May 31, 2011,2012, which was $51.96,$42.48, and the exercise price of the option.

Non-employee Directors | Options Outstanding as of May 31, 2011 (includes vested and unvested) | Value as of May 31, 2011 (includes vested and unvested) | Options Outstanding as of May 31, 2012 (includes vested and unvested) | Value as of May 31, 2012 (includes vested and unvested) | ||||||||||||

Edwin H. Burba, Jr. | 29,894 | $ | 313,258 | 29,894 | $ | 58,569 | ||||||||||

Alex W. Hart | 46,110 | $ | 845,988 | 41,292 | $ | 301,680 | ||||||||||

William I Jacobs | 50,050 | $ | 994,467 | 50,050 | $ | 548,699 | ||||||||||

Raymond L. Killian | 41,292 | $ | 664,422 | 41,292 | $ | 301,680 | ||||||||||

Ruth Ann Marshall | 25,124 | $ | 226,420 | 25,124 | $ | 16,951 | ||||||||||

Alan M. Silberstein | 41,292 | $ | 664,422 | 41,292 | $ | 301,680 | ||||||||||

Michael W. Trapp | 25,124 | $ | 226,420 | 25,124 | $ | 16,951 | ||||||||||

Gerald J. Wilkins | 29,894 | $ | 313,258 | 25,124 | $ | 16,951 | ||||||||||

(5) Non-Qualified Deferred Compensation Plan. The non-employee directors are eligible to participate in the Company’s Non-Qualified Deferred Compensation Plan, or “DC Plan.” Ms. Marshall and Mr. Silberstein are the only directors who participated in the DC plan during fiscal 2011.2012. Pursuant to the DC Plan, non-employee directors are permitted to elect to defer up to 100% of their annual cash retainer and meeting fees. Participant accounts are credited with earnings based on the participant’s investment allocation among a menu of investment options selected by the DC Plan administrator. Participants are 100% vested in the participant deferrals and related earnings. The Company does not make contributions to the DC Plan and does not guarantee any return on participant account balances. Participants may

10

allocate their plan accounts into sub-accounts that are payable upon separation from service or on designated specified dates. Except in the case of death or disability, participants may elect in advance to have their various account balances pay out in a single lump sum or in installments over a period of two to ten years. In the event a participant separates from service by reason of death or

10

disability, the participant or his designated beneficiary will receive the undistributed portion of his or her account balances in a lump-sum payment. Subject to approval by the DC Plan administrator, in the event of an unforeseen financial emergency beyond the participant’s control, a participant may request a withdrawal from an account up to the amount necessary to satisfy the emergency (provided the participant does not have the financial resources to otherwise meet the hardship).

(6) Board Leadership Structure. The Board of Directors does not have a formal policy on whether the same person should serve as the Chairman of the Board and the Chief Executive Officer. Since 2002, however, Mr. Garcia has served in both roles. The Board believes the combined role of Chief Executive Officer and Chairman, together with a lead independent director having the duties described below, is in the best interest of the shareholders because it provides the appropriate balance between strategy development and independent oversight of management. The Board of Directors believes that having our Chief Executive Officer as Chairman of the Board facilitates the Board’s decision-making process because Mr. Garcia possesses detailed and in-depth knowledge of the issues, opportunities, and challenges facing the Company and its business and is thus best positioned to develop agendas (with input from the lead independent director) that ensure that the Board’s time and attention is focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s shareholders, employees, customers, and suppliers.

Mr. Jacobs serves as our lead independent director. The lead independent director’s duties include providing input on the Board meeting agenda items, serving as the chairperson for all executive sessions of the independent directors, and communicating to the Chief Executive Officer the results of the independent executive Board sessions. Executive sessions of the independent directors are generally held immediately after each regularly scheduled meeting of the Board and do not include our only non-independent director.Board. The independent directors of the Board met in executive session seveneight times during our fiscal year ended May 31, 2011.2012.

Any interested party may contact the lead independent director by directing such communications to Mr. Jacobs in care of the Corporate Secretary at our address (10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by usthe Corporate Secretary in accordance with the foregoing sentence will be forwarded to him.

(7) Director Independence. Each year the Board of Directors undertakes a review of director independence based on the standards for director independence included in the New York Stock Exchange corporate governance rules. The Board considers whether or not there existed any relationships and transactions during the past three years between each director or any member of his or her immediate family, on the one hand, and the Company and its subsidiaries and affiliates, on the other hand. The purpose of the review is to determine whether or not any such relationships and transactions existed and, if so, whether any such relationships or transactions were inconsistent with a determination that the director is independent. In fiscal year 2011,2012, there were no such relationships or transactions between the non-employee directors and the Company to review and, as a result, the Board of Directors has determined that all of the directors, except Mr. Garcia (who serves as the Company’s Chief Executive Officer), are independent of the Company and its management.

(8) Committees. Our Board of Directors has a separately-designated Audit Committee, a Compensation Committee, a Governance, Nominating, and Risk Oversight Committee, and a Technology Committee. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board of Directors has determined that all members of the four committees satisfy the independence requirements of the SEC and the New York Stock Exchange. Each of the committee charters and our corporate governance guidelines are available on our website (www.globalpaymentsinc.com), and will be provided free of charge, upon written request of any shareholder addressed to Global Payments Inc., 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473, Attention: Investor Relations. Certain information regarding the functions of the Board’s committees and their present membership is provided below.

(9) Audit Committee. As of the end of fiscal year 2011,2012, the members of the Audit Committee were Mr. Trapp (Chairperson), Mr. Wilkins, and Mr. Silberstein. The Audit Committee operates under a written charter adopted by the Board of Directors which is available on our website (www.globalpaymentsinc.com). The Audit Committee annually

11

reviews a report by the independent auditors describing the firm’s internal quality control procedures; reviews the scope, plan and results of the annual audit of the financial statements by our independent auditors; reviews the scope, plan and results of the internal audit program; reviews the nature and extent of non-audit professional services performed by the independent auditors; and annually recommends to the Board of Directors the firm of independent public accountants to be selected as our independent auditors for the next fiscal year. During fiscal year 2011,2012, the Audit Committee held four meetings, each of which was separate from a regular Board meeting.

(10) Audit Committee Financial Expert. The Board of Directors has determined that the chairman of the Audit Committee, Mr. Trapp, is an audit committee financial expert and is independent as independence for audit committee members is defined under the rules established by the SEC and the New York Stock Exchange.

11

(11) Compensation Committee.As of the end of fiscal year 2011,2012, the members of the Compensation Committee were General Burba (Chairperson), Mr. Hart, Mr. Jacobs, Mr. Killian, and Ms. Marshall. The Committee operates under a written charter which is available on our website (www.globalpaymentsinc.com). This Committee reviews levels of compensation, benefits, and performance criteria for our executive officers and administers the Amended and Restated 2000 Long Term Incentive Plan, the 2000 Employee Stock Purchase Plan, the 2000 Director Plan, and the Amended and Restated 2005 Incentive Plan, and the 2011 Incentive Plan. They also consider our compensation programs from a risk perspective. Additional information regarding risk consideration is contained in the Compensation Tables and Narratives section under the heading “Consideration“Consideration of Risk.Risk”

The Compensation Committee charter allows the Committee to delegate certain matters within its authority to individuals, and the Committee may form and delegate authority to subcommittees as appropriate. In addition, the Committee has the authority under its charter to retain outside advisors to assist the Committee in the performance of its duties, and for fiscal year 20112012 the Committee retained the services of Meridian Compensation Partners LLC, an independent compensation consulting firm. The Compensation Discussion and Analysis section of this proxy statement describes our processes and procedures for the consideration and determination of executive compensation, including the role of the executive officers in determining compensation, and describes the role of the independent consultant in more detail.

During fiscal year 2011, the Compensation Committee also hired Meridian to assist with a review of the director compensation. The Compensation Committee, with Meridian’s assistance, made recommendations to the full Board, which were discussed by the Board and were approved on September 30, 2010 and which took effect on October 2, 2010 and will remain in effect through our 2011 annual meeting.27, 2011. The executives have no role in determining Board compensation. During fiscal year 2011,2012, the Compensation Committee held two meetings, both of which were separate from regular Board meetings.

(12) Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee (a) has ever served as an officer or an employee of the Company or any of its subsidiaries and (b) has ever had any relationship requiring disclosure by the Company under Item 404 of Regulation S-K. None of the Company’s executive officers serves as a member of the board of directors or compensation committee, or similar committee, of any other company that has one or more of its executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

(13) Technology Committee.As of the end of fiscal year 2011,2012, the members of the Technology Committee were Mr. Killian (Chairperson), Mr. Hart, and Mr. Silberstein. The Committeecommittee operates under a written charter which is available on our website (www.globalpaymentsinc.com). This committee is to serve as a liaison between the Board and management with regard to matters related to information technology and information security and to review the practices and key initiatives of the Company related to information technology and information security. During fiscal year 2011,2012, the Technology Committee held three meetings, all of which were separate from regular Board meetings.

(14) Governance, Nominating, and Risk Oversight Committee.As of the end of fiscal year 2011,2012, the members of the Governance, Nominating, and Risk Oversight Committee (the “Governance Committee”) were Mr. Hart (Chairperson), General Burba, Mr. Jacobs, and Ms. Marshall. The Committeecommittee operates under a written charter which is available on our website (www.globalpaymentsinc.com). This committee is responsible for developing and recommending to the Board of Directors a set of corporate governance principles applicable to us, determining the structure of the Board and its committees, for overseeing the Company’s enterprise risk management process (as described in more detail below), and for identifying, nominating, proposing, and qualifying nominees (including incumbent directors) for open seats on the Board of Directors, based primarily on the following criteria:

12

Experience as a member of senior management or director of a significant business corporation, educational institution, or not-for-profit organization;

Particular skills or experience that enhances the overall composition of the Board of Directors;

Serves on no more than five other boards of directors of publicly-held corporations; and

Serves on no more than three other audit committees of boards of directors of publicly-held corporations.

We do not have a formal diversity policy. However, as part of its evaluation of director candidates and in addition to other standards the Governance Committeecommittee may deem appropriate from time to time for the overall structure and composition of the Board, the Committee considers whether each candidate, if elected, assists in achieving a mix of board members that represent a diversity of background and experience. Accordingly, the Board seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer the Company and its shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. The Committee also considers the independence of candidates for director nominees, including the appearance of

12

any conflict in serving as a director. Candidates for director nominees who do not meet all of these criteria may still be considered for nomination to the Board if the Committee believes the candidate will make an exceptional contribution to the Company and its shareholders. In evaluating nominees, the Committee will also take into account the consideration that members of the Board of Directors should collectively possess a broad range of skills, expertise, industry knowledge and other knowledge, business experience and other experience useful to the effective oversight of our business.

The Governance Committee considers candidates for director who are recommended by other members of the Board of Directors and by management, as well as those identified by any outside consultants who are periodically retained by the Committee to assist in identifying possible candidates. The Governance Committee will evaluate potential nominees for open Board positions suggested by shareholders on the same basis as all other potential nominees. Nominations from shareholders for the 2013 annual meeting must be received by the Company on or after March 13, 2013 and on or before April 12, 2013. To recommend a potential nominee, you may send a letter to the Corporate Secretary, Global Payments Inc., 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328. Such letter should include the following information:

Name and address of the shareholder making the recommendation, as it appears on our books and records;

Number of shares of our capital stock that are owned by such shareholder;

Name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five full fiscal years of the individual recommended for consideration as a director nominee;

All other information relating to the recommended candidate that would be required to be disclosed in solicitations of proxies for the election of directors or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act, including the recommended candidate’s written consent to being named in the proxy statement as a nominee and to serving as a director if approved by the boardBoard of directorsDirectors and elected; and

A written statement from the shareholder making the recommendation stating why such recommended candidate meets our criteria and would be able to fulfill the duties of a director.

Members of the Governance Committee must discuss and evaluate possible candidates prior to recommending them to the Board. This committee had twothree meetings during fiscal year 2011.2012.

(15) Majority Voting.The Board of Directors has approved the corporate governance guideline described below regarding majority voting. In an uncontested election of directors (i.e., an election where the only nominees are those recommended by the Board), any nominee for director who receives a greater number of votes “withheld” from his or her election (excluding broker and nominee non-votes) than votes “for” his or her election will be required to promptly tender his or her resignation to the Board following certification of the shareholder vote in accordance with the Director Code of Conduct and Ethics.

The Governance Committee will promptly consider any resignation submitted by a director in accordance with the foregoing paragraph and the Governance Committee will recommend to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. In considering whether to accept or reject the tendered resignation, the Governance Committee will consider all factors deemed relevant by the members of the Governance Committee including, without limitation, the stated reasons why shareholders “withheld” votes for election from such

13

director, the length of service and qualifications of the director whose resignation has been tendered, the director’s contributions to the Company, and the Company’s Corporate Governance Guidelines.

The Board will act on the Governance Committee’s recommendation and publicly disclose its decision within 90 days from the date of the certification of the election results. In considering the Governance Committee’s recommendation, the Board will consider the factors considered by the Governance Committee and such additional information and factors the Board believes to be relevant. Following the Board’s decision on the Governance Committee’s recommendation, the Company will promptly publicly disclose the Board’s decision whether to accept the resignation as tendered (providing an explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the tendered resignation) in a Form 8-K filed with the Securities and Exchange Commission.SEC. Any director who tenders his or her resignation pursuant to this provision will not participate in the Governance Committee’s or the Board’s recommendation or decision, or any deliberations related thereto.

(16) Role in Risk Oversight by the Board of Directors.Managing risk is an ongoing process inherent in all decisions made by management. The Board of Directors discusses risk throughout the year, particularly at Board and Committee

13

meetings when specific actions are considered for approval. The Board of Directors has ultimate responsibility to oversee risk which they accomplish through the Company’smanagement reporting process. The Company has created an enterprise risk management program (“ERM”). The program and the Governance Committee has been appointed by our Board of Directors to coordinate the oversight of the ERM program by the Board.

In connection with the Company’s ERM, the Company has formedestablished a management risk committee, which is comprised of the Company’s senior management and whichof the Company, who is responsible for identifying, assessing, prioritizing, and developing action plans to mitigatemitigating the material risks affecting the Company including monitoring the business environment for changes in and emergence of significant risks. The Governance Committee’s role in overseeing the management of the process is primarily accomplished through the management reporting process, including receiving reports from the chairman of the management risk committee and other members of senior management on areas of material risk to the Company. The Chairman of the Governance Committee will update the full Board of Directors on the process after each Committee meeting and, periodically, the chairman of the management risk committee will also present directly to the full board and seek their input and direction on the process.

The Audit Committee receives reports from the Chairman of the Governance Committee regarding the Company’s ERM, receives a report periodically from the chairman of the management risk committee as described above, and receives reports regularly from theCompany also has an internal auditor, whoaudit department, which has responsibility for providing an independent risk assessment and an assessment of the effectiveness of management’sthe risk mitigation activities developed by management. The Audit Committee directly provides oversight of risks related to the integrity of the consolidated financial statements, internal control over financial reporting, and the internal audit function. The Compensation Committee oversees the management of risks related to management succession planning and the Company’s executive compensation program.

(17) Communications from Security Holders. Any security holder may contact any member of the Board of Directors by directing such communication to such Board member in care of the Corporate Secretary at our address (10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by usthe Corporate Secretary in accordance with the foregoing sentence shall be forwarded to the applicable Board member.

(18) Attendance at Annual Meeting. All directors are expected to attend our annual meeting of shareholders. All nineSeven members of our Board of Directors attended our fiscal year 20102011 annual shareholder meeting.

(19) Certain Legal Proceedings. William I Jacobs, a member of the Board of Directors, was the Chief Financial Officermeeting in person and Managing Director of The New Power Company, a subsidiary of NewPower Holdings, Inc. Both The New Power Company and NewPower Holdings, Inc. filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Northern District of Georgia on June 11, 2002.two members participated by telephone.

14

PROPOSAL TWO:

APPROVAL OF THE COMPANY’S 2011 INCENTIVE PLAN

The Board of Directors has adopted, subject to shareholder approval at the Annual Meeting, the Global Payments Inc. 2011 Incentive Plan (the “2011 Plan”). The 2011 Plan will become effective as of the date it is approved by the shareholders.

The 2011 Plan is intended to serve as the successor to the Company’s Third Amended and Restated 2005 Incentive Plan (the “2005 Plan”). As of August 5, 2011, there were approximately 977,296 shares of our Common Stock reserved and available for future awards under the 2005 Plan. If our shareholders approve the 2011 Plan, all future equity awards will be made from the 2011 Plan, and we will not grant any additional awards under the 2005 Plan. However, the Company reserves the right to pay other types of compensation outside of this new plan.

The Board of Directors recommends that the shareholders vote “FOR” approval of adoption of the 2011 Plan. The proxies solicited on behalf of the Board of Directors will be voted in favor of approval of adoption of the 2011 Plan unless otherwise specified. This proposal No. 2 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal (including abstentions); provided that the total votes cast on the proposal (including abstentions) must represent over 50% of the total outstanding shares of our Common Stock.

A summary of the 2011 Plan is set forth below. This summary is qualified in its entirety by the full text of the 2011 Plan, which is attached to this Proxy Statement as Appendix A.

(1) Purpose and Eligibility.The purpose of the 2011 Plan is to promote the Company’s success by linking the personal interests of its employees, officers, directors and consultants to those of the Company’s shareholders, and by providing participants with an incentive for outstanding performance. As of May 31, 2011, approximately 1343 employees and 8 non-employee directors would be eligible to participate in the 2011 Plan.

(2) Administration.The 2011 Plan will be administered by the Compensation Committee of the Board of Directors or such other committee of the Board as may be designated by the Board to administer the 2011 Plan, either of which we refer to as the “Committee” in this Proposal. The Committee will have the authority to: designate participants; grant awards; determine the type or types of awards to be granted to each participant and the number, terms and conditions thereof; establish, adopt or revise any rules and regulations as it may deem advisable to administer the 2011 Plan; and make all other decisions and determinations that may be required under the 2011 Plan.

(3) Awards to Non-Employee Directors.Notwithstanding the above, awards granted under the 2011 Plan to the Company’s non-employee directors will be made only in accordance with the terms, conditions and parameters of a plan, program or policy for the compensation of non-employee directors as in effect from time to time. The Committee may not make discretionary grants under the 2011 Plan to non-employee directors outside of such established program for director compensation.

(4) Permissible Awards. The 2011 Plan authorizes the granting of awards in any of the following forms:

market-priced options to purchase shares of our Common Stock, which may be designated under the Internal Revenue Code (the “Code”) as nonqualified stock options (which may be granted to all participants) or incentive stock options (which may be granted to officers and employees but not to consultants or non-employee directors);

stock appreciation rights (“SARs”), which give the holder the right to receive the difference (payable in cash or stock, as specified in the award agreement) between the fair market value per share of our Common Stock on the date of exercise over the base price of the award (which cannot be less than the fair market value of the underlying stock as of the grant date);

restricted stock, which is subject to restrictions on transferability and subject to forfeiture on terms set by the Committee;

stock units, which represent the right to receive shares of Common Stock (or an equivalent value in cash or other property, as specified in the award agreement) at a designated time in the future and subject to any

15

|

performance awards, which represent any award of the types listed above which have a performance-vesting component based on the achievement, or the level of achievement, of one or more performance goals during a specified performance period, as established by the Committee;

other stock-based awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on shares of Common Stock, including unrestricted stock grants, purchase rights, or other rights or securities that are convertible or exchangeable into shares of Common Stock;

dividend equivalents, which entitle the participant to payments (or an equivalent value payable in stock or other property) equal to any dividends paid on the shares of stock underlying an award other than an option or stock appreciation right; and

cash-based awards, including performance-based annual bonus awards.

(5) Shares Available for Awards.The aggregate number of shares of Common Stock that may be issued under the 2011 Plan is 7,000,000 shares, subject to proportionate adjustment in the event of stock splits and similar events. Shares underlying options and SARs will count as four tenths of 1 share, and shares underlying all other stock-based awards will count as 1 share, against the number of shares available for issuance under the 2011 Plan. Shares subject to awards that terminate or expire unexercised, or are cancelled, forfeited or lapse for any reason, and shares underlying awards that are ultimately settled in cash, will again become available for future grants of awards under the 2011 Plan. To the extent that the full number of shares subject to a full-value award is not issued for any reason, including by reason of failure to achieve maximum performance goals, the unissued shares originally subject to the award will be added back to the plan share reserve. Shares delivered by the participant or withheld from an award to satisfy tax withholding requirements, and shares delivered or withheld to pay the exercise price of an option, will not be used to replenish the plan share reserve. The Committee may grant awards under the 2011 Plan in substitution for awards held by employees of another entity who become employees of the Company as a result of a business combination, and such substitute awards will not count against the plan share reserve. No awards may be granted under the 2011 Plan after the tenth anniversary of the effective date.

(6) Limitations on Awards.The maximum aggregate number of shares of Common Stock subject to time-vesting options or time-vesting SARs that may be granted under the 2011 Plan in any 12-month period to any one participant is 600,000 each. The maximum aggregate dollar value or number of shares of Common Stock subject to performance-vesting awards under the 2011 Plan that may be paid in any 12-month period to any one participant is as follows:

performance awards settled in Common Stock, the greater of 600,000 shares or shares having a fair market value of $30 million as of the date of grant of the award; and

performance awards settled in cash or property other than shares of Common Stock, $10 million.

For purposes of applying these limits in the case of multi-year performance periods, the amount of cash or property or number of shares deemed paid in any one 12-month period is the total amount payable or shares earned for the performance period divided by the number of 12-month periods in the performance period.

(7)Minimum Vesting Requirements. Except in the case of substitute awards granted in a business combination as described above, full-value awards shall either (i) be subject to a minimum vesting period of three years (which may include graduated vesting within such three-year period), or one year if the vesting is based on performance criteria other than continued service, or (ii) be granted solely in exchange for foregone cash compensation. However, the Committee may accelerate vesting of such full-value awards in the event of the participant’s termination or upon the occurrence of a change in control and the minimum vesting requirements shall not apply to awards made to non-employee directors.

(8) Qualified Performance-Based Awards.All options and stock appreciation rights granted under the 2011 Plan are designed to be exempt from the $1,000,000 deduction limit imposed by Code Section 162(m). The Committee may designate any other award granted under the 2011 Plan as a qualified performance-based award in order to make the award fully deductible without regard to the $1,000,000 deduction limit imposed by Code Section 162(m). If an award is so designated, the Committee must establish objectively determinable performance goals for the award based on one or more of the following business criteria, which may be expressed in terms of Company-wide objectives or in terms of objectives that relate to the performance of an affiliate or a division, region, department or function within the Company or an affiliate over a performance term to be designated by the Committee that may be as short as a calendar quarter or other three-month period:

16

Revenue (premium revenue, total revenue or other revenue measures)

Sales

Profit (net profit, gross profit, operating profit, economic profit, profit margins or other corporate profit measures)

Earnings (EBIT, EBITDA, earnings per share, or other corporate earnings measures)

Net income (before or after taxes, operating income or other income measures)

Cash (cash flow, cash generation or other cash measures)

Stock price or performance

Total shareholder return (stock price appreciation plus reinvested dividends divided by beginning share price)

Economic value added

Return measures (including, but not limited to, return on assets, capital, equity, investments or sales, and cash flow return on assets, capital, equity, or sales)

Market share

Improvements in capital structure

Expenses (expense management, expense ratio, expense efficiency ratios or other expense measures)

Business expansion (acquisitions)

Internal rate of return or increase in net present value

Productivity measures

Cost reduction measures

Strategic plan development and implementation

The Committee must establish such goals within the first 25% of the period for which such performance goal relates (or such later date as may be permitted under applicable tax regulations) and the Committee may for any reason reduce (but not increase) any award, notwithstanding the achievement of a specified goal. The Committee may not waive the achievement of any specified goal, except in the case of death or disability of the participant or a change in control. The Committee may provide, at the time the performance goals are established, that any evaluation of performance shall exclude or otherwise objectively adjust for any specified circumstance or event that occurs during a performance period, including by way of example but without limitation the following: (a) asset write-downs or impairment charges; (b) litigation or claim judgments or settlements; (c) the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results; (d) accruals for reorganization and restructuring programs; (e) extraordinary nonrecurring items as described in then-current accounting principles; (f) extraordinary nonrecurring items as described in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s annual report to shareholders for the applicable year; (g) acquisitions or divestitures; and (h) foreign exchange gains and losses. Any payment of an award granted with performance goals will be conditioned on the written certification of the Committee in each case that the performance goals and any other material conditions were satisfied.

(9) Treatment of Awards upon a Participant’s Termination of Service.Unless otherwise provided in an award agreement or any special plan document governing an award, upon the termination of a participant’s service due to death:

all of that participant’s outstanding options and stock appreciation rights will become fully vested and exercisable and will remain exercisable for one year thereafter (or the earlier end of the term of the award) and

all time-based vesting restrictions on that participant’s outstanding awards will lapse as of the date of termination.

In addition, subject to limitations applicable to certain qualified performance-based awards, the Committee may, in its discretion accelerate awards upon the termination of service of a participant or the occurrence of a change in control. The Committee may discriminate among participants or among awards in exercising such discretion.

17

(10) Anti-dilution Adjustments.In the event of a transaction between us and our shareholders that causes the per-share value of our Common Stock to change (including, without limitation, any stock dividend, stock split, spin-off, rights offering or large nonrecurring cash dividend), the share authorization limits and annual award limits under the 2011 Plan will be adjusted proportionately, and the Committee shall make such adjustments to the 2011 Plan and awards as it deems necessary, in its sole discretion, to prevent dilution or enlargement of rights immediately resulting from such transaction. In the event of a stock split, a stock dividend, or a combination or consolidation of the outstanding shares of our Common Stock into a lesser number of shares, the authorization limits and annual award limits under the 2011 Plan will automatically be adjusted proportionately, and the shares then subject to each award will automatically be adjusted proportionately without any change in the aggregate purchase price.

(11) Amendment and Termination of the 2011 Plan. The Board or the Committee may amend, suspend or terminate the 2011 Plan at any time, except that no amendment may be made without the approval of the Company’s shareholders if shareholder approval is required by any federal or state law or regulation or by the rules of any stock exchange on which the Common Stock may then be listed, or if the amendment, alteration or other change materially increases the number of shares available under the 2011 Plan, expands the types of awards available under the 2011 Plan, materially expands the class of participants eligible to participate in the Plan, materially extends the term of the Plan, or if the Board or Committee its discretion determines that obtaining such shareholder approval is for any reason advisable. No termination or amendment of the 2011 Plan may, without the written consent of the participant, reduce or diminish the value of an outstanding award. The Committee may amend or terminate outstanding awards. However, such amendments may require the consent of the participant and, unless approved by our shareholders, the exercise price of an outstanding option or stock appreciation right may not be reduced, directly or indirectly, and the original term of an option or stock appreciation right may not be extended.

(12) Prohibition on Repricing.As indicated above under “Amendment and Termination,” outstanding stock options and SARs cannot be repriced, directly or indirectly, without the prior consent of the Company’s shareholders. The exchange of an “underwater” option or SAR (i.e., an option or SAR having an exercise or base price in excess of the current market value of the underling stock) for another award or for a cash payment would be considered an indirect repricing and would, therefore, require the prior consent of the Company’s shareholders.

(13) Limitations on Transfer; Beneficiaries.No right or interest of a participant in any award may be pledged or encumbered to or in favor of any person other than the Company, or be subject to any lien, obligation or liability of the participant to any person other than the Company or an affiliate. Except to the extent otherwise determined by the Committee with respect to awards other than incentive stock options, no award may be assignable or transferable by a participant otherwise than by will or the laws of descent and distribution, and any option or other purchase right shall be exercisable during the participant’s lifetime only by such participant. A beneficiary, guardian, legal representative or other person claiming any rights under the 2011 Plan from or through a participant will be subject to all the terms and conditions of the 2011 Plan and any award agreement applicable to the participant.

(14) Clawback Policy.Awards under the 2011 Plan will be subject to any compensation recoupment policy (sometimes referred to as a “clawback policy”) of the Company as adopted from time to time.

The U.S. federal income tax discussion set forth below is intended for general information only and does not purport to be a complete analysis of all of the potential tax effects of the 2011 Plan. It is based upon laws, regulations, rulings and decisions now in effect, all of which are subject to change. State, local and ex-U.S. income tax consequences are not discussed, and may vary from jurisdiction to jurisdiction.

(1) Nonqualified StockOptions.There will be no federal income tax consequences to the optionee or to the Company upon the grant of a Nonqualified stock option under the 2011 Plan. When the optionee exercises a Nonqualified option, however, he or she will recognize ordinary income in an amount equal to the excess of the fair market value of the stock received upon exercise of the option at the time of exercise over the exercise price, and the Company will be allowed a corresponding federal income tax deduction. Any gain that the optionee realizes when he or she later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

18

(2) Incentive Stock Options. There will be no federal income tax consequences to the optionee or to the Company upon the grant of an incentive stock option. If the optionee holds the option shares for the required holding period of at least two years after the date the option was granted and one year after exercise, the difference between the exercise price and the amount realized upon sale or disposition of the option shares will be long-term capital gain or loss, and the Company will not be entitled to a federal income tax deduction. If the optionee disposes of the option shares in a sale, exchange, or other disqualifying disposition before the required holding period ends, he or she will recognize taxable ordinary income in an amount equal to the excess of the fair market value of the option shares at the time of exercise over the exercise price, and the Company will be allowed a federal income tax deduction equal to such amount. While the exercise of an incentive stock option does not result in current taxable income, the excess of the fair market value of the option shares at the time of exercise over the exercise price will be an item of adjustment for purposes of determining the optionee’s alternative minimum taxable income.

(3) Stock Appreciation Rights.A participant receiving a stock appreciation right under the 2011 Plan will not recognize income, and the Company will not be allowed a tax deduction, at the time the award is granted. When the participant exercises the stock appreciation right, the amount of cash and the fair market value of any shares of stock received will be ordinary income to the participant and the Company will be allowed a corresponding federal income tax deduction at that time.